Day trading can feel like a wild ride, full of ups and downs. Many traders search for stocks with just the right mix of volatility and liquidity to make quick moves. After careful research, this blog shares some top picks that fit those needs perfectly.

Stick around—it might just change how you trade.

Criteria for Selecting Top Day Trading Stocks

Choosing the right stock can make or break your day trading game. Look for stocks that move often and grab attention in the market.

High Liquidity

I stick to stocks with high liquidity because they trade fast, like lightning in a storm. High liquidity means I can buy or sell quickly without waiting forever or seeing wild price shifts.

For example, SoundHound AI Inc. (NASDAQ: SOUN) showed strong trading volume at 142,785. That’s the type of stock that keeps me confident as a day trader.

Low-volume stocks feel like getting stuck in traffic—no movement and no action. Cerence Inc. (NASDAQ: CRNC), with just 8,032 trades recently, offers less flexibility for quick decisions.

High trading volume often signals more interest from other traders and tighter bid/ask spreads for better transactions on each deal I make!

VolatilityVolatility makes day trading exciting. Prices can swing wildly, creating chances for quick gains—or losses. Take Quantum Computing Inc. (NASDAQ: QUBT) as an example. Its stock spiked 1,800% after its first order on November 13.

Moves like that don’t happen every day.

Cerence Inc. (NASDAQ: CRNC) also caught my eye before with a massive 240% price jump. These rapid shifts need focus and fast decisions. High volatility brings opportunities but demands risk management like stop-loss orders to avoid big hits in the stock market.

Big risks often bring big rewards—but only if you’re prepared.

Strong Company Fundamentals

I focus on firms with a solid base. For example, Vir Biotechnology Inc. (NASDAQ: VIR) showed this strength on January 8. Positive cancer trial results caused its stock to jump by 80%.

That’s no fluke—strong fundamentals drive growth like this.

22nd Century Group Inc. (NASDAQ: XXII) is another example. On January 13, it backed FDA nicotine rules for cigarettes, boosting investor trust. A company with clear goals and strong financials stands tall in the fast-moving market world of day trading and volatile stocks!

Top Stocks to Watch for Day Trading in January 2025

Day traders thrive on stocks with big price swings and high trading volume. These picks offer exciting opportunities, but you’ll need sharp focus and smart strategies to make the most of them.

Cerence Inc. (NASDAQ: CRNC)

Cerence Inc. trades at $12.50, dropping 0.64% or $0.08 today. Its trading volume sits low at 8,032 with a float of 42.32M shares. I noticed its recent news about teaming up more with NVIDIA on January 3, which catches my eye for potential moves in tech-related sectors.

This stock’s price movements show modest volatility now but could shift fast given market trends or new announcements like the NVIDIA deal. Strong partnerships often stir price fluctuations that day traders love to ride out for quick gains.

SoundHound AI Inc (NASDAQ: SOUN)

SoundHound AI Inc (NASDAQ: SOUN) caught my attention with its sharp price swings. The stock jumped 2.49% to $13.98, gaining $0.34 in a single session. Trading volume hit 142,785 shares, which shows decent activity for day traders like me.

Its float is at 282.86 million, offering liquidity for quick moves.

This company has had wild price shifts before, moving between $1 and $4.50 at times but peaking in the mid-$20s during highs. Volatility like this makes it great for fast trades if timed right.

I watch its trading patterns closely since it often reacts strongly to market news or updates in artificial intelligence trends—perfect for short-term profits!

Quantum Computing Inc (NASDAQ: QUBT)

SoundHound caught my attention, but Quantum Computing Inc (QUBT) also has some serious sparks. Its stock price is $9.93, with a 1.02% gain (+$0.10). I noticed its volume reached 228,564 shares, which hints at growing interest.

What really turned heads was its massive 1,800% spike after landing its first order on November 13.

This company isn’t just riding on hype; it’s backed by potential in ultramodern tech like quantum computing and AI integration. With a float of 59.09M shares, liquidity looks decent for day trading moves too.

Vir Biotechnology Inc (NASDAQ: VIR)

Vir Biotechnology Inc. caught my eye after its stock price jumped 80% on January 8. Positive cancer treatment trial data fueled this spike, making it a tempting pick for day trading.

Now the stock sits at $10.03, down 0.79%, or $0.08.

Volume is low, with just 12 shares traded recently, so liquidity might be an issue for quick trades. Volatility like this can lead to big opportunities but also sharp risks. I keep stop-loss orders ready and closely watch technical analysis signals before acting on a move here.

22nd Century Group Inc (NASDAQ: XXII)

22nd Century Group Inc saw a 150% share price spike. It now trades at $5.42, climbing 6.27% or $0.32 today alone. The volume hit 3,962 with a small float of only 455,100 shares, which makes it highly volatile.

I focus on stocks like this for day trading because such sharp moves create profit chances. Its low float means quick price swings are likely as demand changes fast. Keep an eye on its trading volume and set strict stop-loss orders to manage risk wisely in case the trend reverses.

Nauticus Robotics Inc. (NASDAQ: KITT)

Nauticus Robotics Inc. caught my eye after a 5.31% rise in stock price to $2.38. It gained $0.12 on January 3, showing some solid upward momentum for day trading fans like me. The trading volume hit 72,483, with a float of just 5.64M shares—making it appealing for those who chase volatile stocks.

This company showed significant movement that day and stayed on my radar for its potential short bursts of activity. I focus on quick trades, so such volatility suits my goals well.

Using stop-loss orders here can protect against surprises while aiming to ride the highs efficiently!

Richtech Robotics Inc. (NASDAQ: RR)

Richtech Robotics Inc. (NASDAQ: RR) caught my eye with its $3.03 stock price, down 2.26% or $0.07 today. The trading volume sits at 85,136, which shows decent movement for short-term trades.

Its float is only 17.65M shares, opening the door for sharp swings in price action.

I’ve seen stocks like this jump unexpectedly due to a history of quick price spikes—perfect for day-trading strategies that rely on volatility. Keeping an eye on these moves can help spot opportunities before they fade away.

With liquidity high enough to avoid illiquid securities issues, it appeals to traders ready to act fast in volatile moments while managing risk smartly using stop-loss orders or position sizing techniques.

Daily Strategies for Day Trading

Trading isn’t just luck; it takes a game plan. Stick to rules, keep emotions in check, and focus on the data.

See Trading Patterns

Spotting patterns is like solving a puzzle. I look for trends in price, volume, and momentum. For example, Nauticus Robotics Inc (KITT) showed strength recently in the robotics area.

It’s pivotal to catch these moves early before they break out or reverse.

SoundHound AI Inc saw quick swings this month too, hinting at volatility traders love. Watching charts daily helps me spot flags, head-and-shoulders patterns, or double bottoms forming.

These clues guide my buy and sell points efficiently while reducing risks.

Set Entry and Exit Rules

I fix entry and exit points by spotting support and resistance levels. I watch for intraday bounces at those areas. If a stock drops near its support, I buy expecting it to rebound.

When it hits resistance, I sell quickly to lock in profits.

Stop-loss orders help cut losses early. For example, if a stock falls 5% below my buy price, I sell fast. This protects me from bigger losses. On the flip side, take-profit targets ensure gains don’t slip away during spikes.

Planning ahead keeps trades smooth and stress-free.

Manage Risk Effectively

Set stop-loss orders to limit losses. I stick to my pre-set risk levels every day. This helps keep emotions in check, especially with volatile stocks or meme stocks. Penny stocks may tempt traders but can be highly risky without a clear plan.

Position sizing matters too. I never bet more than I’m willing to lose on a single trade. Big wins feel great, but sudden losses hurt worse if you’re not ready for them. Now, let’s explore tools and resources that help day traders stay sharp during the action.

Tools and Resources for Day Traders

Day trading demands sharp tools and reliable resources. Quick decisions need real-time data, smart tech, and a strong support network.

Real-time Data Feeds

I rely on real-time data feeds to act fast in trading. They give live updates on stock prices, trading volume, and market data. A platform like StocksToTrade helps me track these changes quickly.

It scans news and offers advanced charts for better decisions.

With real-time updates, I spot volatile stocks or a sudden IPO launch immediately. For instance, catching Tesla Inc.’s price shifts can mean big opportunities. Using this tool has saved me from missing pivotal trades many times during busy markets.

Technical Analysis Software

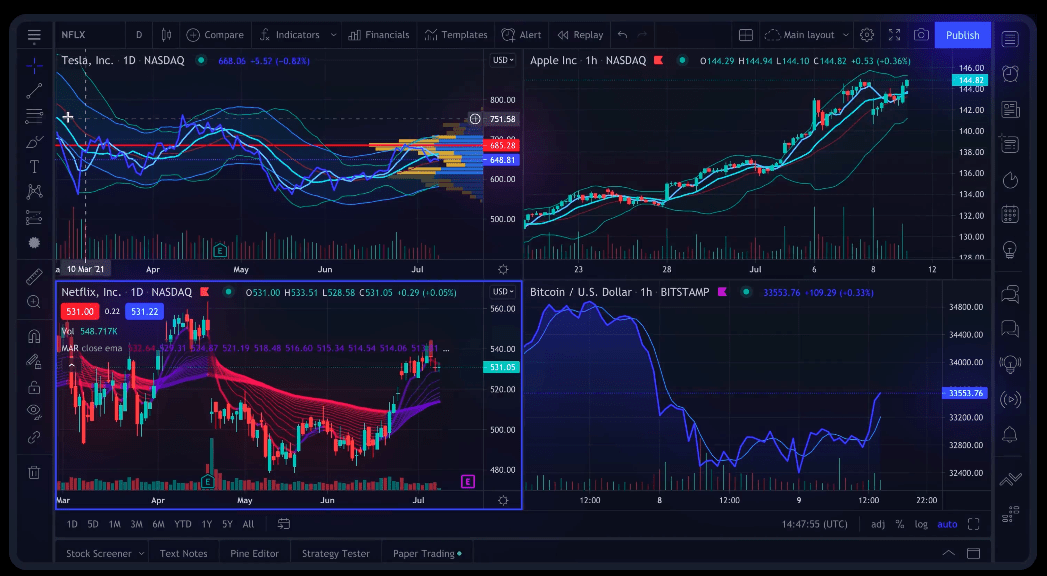

Real-time data feeds are great, but strong technical analysis tools take trading to the next level. I use platforms like StocksToTrade for advanced charting and precise trade setups.

These programs help me track moving averages, RSI trends, and MACD signals quickly.

Volume indicators are a must in day trading volatile stocks or crypto. They show where market energy flows—vital for timing entries and exits. With such software, spotting patterns feels as smooth as butter on toast.

Accurate tools save time and reduce mistakes while trading fast-moving assets like meme stocks or Tesla’s shares.

Day Trading Communities

Trading alone can feel like flying blind. Day trading communities offer a safety net. I join these groups to swap ideas, test strategies, and stay sharp. They’re packed with traders who share maxims about volatile stocks or meme stocks moving the market.

I find it helpful to learn from others’ wins and mistakes in real time. Communities often host live webinars or strategy sessions like Daily Income Trader does. It’s a goldmine for learning tactics while building my personal trading style.

Conclusion

Day trading demands sharp focus and a solid plan. The right stocks can make or break your day. Stay alert to patterns, price moves, and volume spikes. Tools like real-time data and charts are pivotal allies.

Stick to your rules, cut losses fast, and trade smart every time!