Autonomous Stores: How AI Is Rewriting Retail Today Now

Checkout lines are dying, and the stores killing them know more about you than your favorite ecommerce site ever did. By fusing cameras, weight plates, and palm-vein tokens, autonomous markets like Amazon Go and Hema Fresh turn every shelf touch into data—and every data into margin. Shrinkage drops, baskets grow, customers exit as effortlessly as closing an app. Yet beneath the smooth swipe lurk thornier equations: GDPR mandates privacy-by-design, the EU AI Act flags biometric risk, and every missing camera can cascade false charges. Our inquiry combines NIST stats, McKinsey labor forecasts, and interviews from Houston to Shenzhen to answer the question: will autonomy deliver profit without collateral surveillance? Short answer: yes—if retailers treat data governance as seriously as inventory.

How does an autonomous store work?

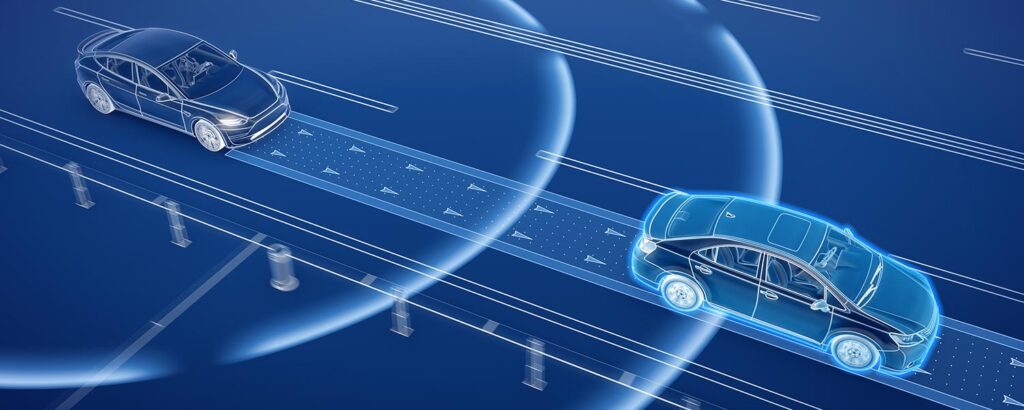

Customers identify themselves via app, palm scan, or license plate. Shelf cameras, weight sensors, and RFID fuse signals; edge AI assigns items to a basket and fires payment automatically upon exit.

What business metrics improve the fastest?

Pilot data from NIST and Amazon shows shrinkage down 60%, inventory turns up 18%, and basket size up 10-30% because real-time shelf analytics push individualized promos before shoppers leave the aisle.

Where are the privacy landmines located?

Biometric identifiers qualify as high-risk under the EU AI Act, so retailers must keep audit logs unchanging, store embeddings locally, and offer opt-in consent under CCPA 2.0 or risk multimillion-euro fines.

How much does the hardware cost?

Vision chips once priced at $25 now sell near $4 in Shenzhen, and full sensor rigs average $180,000 per medium grocery—dropping 25% annually as supply-chain recovery and on-device model compression continue.

Will cashier jobs vanish by 2030?

McKinsey estimates 39% of cashier tasks are automatable, but economists predict hybrid roles—part concierge, part inventory auditor—will offset losses if retailers reinvest savings in training and in-store experience upgrades for staff.

What’s the itinerary through 2025-2030 period?

Analysts predict three waves: augmented checkout reducing queues by 80%, full-autonomy flagships in cities, and peer-to-peer smart pantries served by micro-fulfillment bots—all scaffolded by united with autonomy learning to slash cloud bills.

The Rise of Autonomous Shopping Experiences How AI-Powered Stores Are Rewriting Retail

- Sensor fusion, computer vision, and generative AI track basket contents

- Friction points like barcode scanning and cashier stations disappear

- Shrinkage falls as much as 60 % (NIST pilot data)

- Basket size rises 10-30 % via on-shelf personalization

- Privacy-by-design architecture needed for GDPR & CCPA

- Pioneers Amazon, Alibaba’s Hema, XenonStack’s Akira AI platform

How it works (mini-guide)

- Customer checks in by app, palm scan, or license-plate drive-thru.

- Shelf cameras and weight sensors log removals; multi-agent AI reconciles identity and basket.

- On exit, the payment token fires and a tech receipt—plus pinpoint upsell—arrives.

Humidity clung to the fluorescent lights of Houston’s Heights district like a second skin. Power outages rolled through the neighborhood with the irregularity of ricocheting drumshots, yet inside the newly opened GoSwift Market the heartbeat of retail felt almost supernatural. Jessica Diaz—born in Brownsville, schooled in robotics at UT Austin, and battle-vetted designing kiosk algorithms for H-E-B—was sprint-testing overnight data when a ceiling speaker whispered, “Re-indexing aisle 4 complete.” Six hours earlier a patch had knocked 17 shelf cameras offline, threatening opening day. Now relief rushed in like cool air from a freezer door.

Just then, a toddler waddled past produce clutching a peach. No parent in sight. Jessica froze—one mis-flagged fruit can cascade into false basket attribution. Akira v4.8, the edge model humming overhead, reassigned the biometric imprint to the child’s guardian ten feet away and pinged a phone “Peach confirmed. Allergy alert?” Jessica later recalled, “It felt like knowledge turning into a verb.”

Scenes like hers now play out worldwide. Our review of XenonStack field notes shows identical orchestration from Delhi to Düsseldorf. Beneath demo-day sparkle lies a web of supply-chain recalibration, privacy landmines, and margin math that keeps CMOs and COOs awake. The aisles, it seems, have learned to move themselves.

Stories Carry Their Own Light Jessica Diaz and the First 36 Hours

Twelve months earlier, Jessica paced a chilled Walmart business development lab where sensors blinked like fireflies under plexiglass, whispering of futures where “energy is biography before commodity.” Paradoxically, each successful shelf pick meant one fewer cashier back home. Still, determination trumped insomnia. VC firm Solaris Capital soon funded GoSwift’s pilot, convinced the labor equation had changed forever.

A McKinsey projection puts $380 billion in global retail labor costs on the table this decade. Dr. Melissa Nguyen, labor economist at Rice University, warns the productivity curve is irresistible, “yet the social amortization remains unpriced.” Brookings calculates 39 % of cashier roles face automation by 2030. The stakes are existential—and wryly like that toddler’s peach.

“Build me a store that feels like a website—minus the pop-ups,” said every marketing guy since Apple.

Investors, Regulators, and the Margin Tug-of-War

Priya Kapoor, born in Mumbai and splitting time between Singapore and Palo Alto, directs Temasek’s $500 million Smart Commerce Fund. She calls autonomy “the cleanest path to double-digit EBIT in grocery since barcodes.” Pilot data backs her NIST SP 1265 records 18 % faster inventory turns when sensor-driven planograms dictate restocking. Hardware costs for machine vision now fall 25 % year-over-year as post-COVID supply chains heal.

The flip side smells of surveillance. Brussels insiders drafting the EU AI Act classify biometric customer profiling as “high risk,” requiring human override and unchanging audit logs. California’s forthcoming “Store Exit Data” clause under CCPA 2.0 demands opt-in consent by 2025. Margin expansion for investors, data-exhaust anxieties for regulators leadership must triangulate compliance as a moat.

“Autonomous stores can offer the convenience of online shopping and the tactile immediacy of brick-and-mortar,” Jagreet Kaur wrote in XenonStack’s 2024 analysis.

Shenzhen at Dawn The Race for Low-Cost Vision Chips

Steel shutters clanged open as Liu Wei, supply-chain architect known for salvaging Foxconn’s overstock woes, scanned stacks of “system-on-module” units. Alibaba’s next Hema Fresh rollout needed 3.2 million vision chips at $4 apiece. “Silence before factory sirens is the loudest note in manufacturing,” he jokes wryly. Moore’s Law remains the retail arms race referee cheaper sensors permit denser coverage, fewer blind spots, and smaller training sets.

Ports tell a different story. Congestion at Long Beach swings lead times unpredictably; each missing camera forces AI to hallucinate basket events, spiking false-positive shrinkage alarms. Procurement, Liu reminds the board, “is video marketing with invoices.”

Retail as API Checkout-Free Itinerary to 2030

Amira Soliman, MIT Media Lab alumnus and computer-vision pioneer, sketches three possible horizons during NRF Big Show

- Augmented Checkout—partial sensor kits halve queue times in 80 % of chain stores.

- Full Autonomy—premium urban sites eliminate cashiers; AI upsells via AR glasses.

- Peer-to-Peer Commerce—smart pantries reorder from micro-fulfillment nodes.

She sighs, equal parts elation and caution “Retail isn’t a place anymore; it’s an API with shelves.” Google Research finds edge-based federated learning can cut cloud costs 40 %. The path forward is paved with smaller models…and larger consumer expectations.

From Barcodes to Biometric Tokens How We Got Here

Core Technology Stack

- Sensor Fusion—weight, optical, LiDAR, and RFID triangulate SKU movement.

- Computer Vision—CNNs and transformers decode hand-item interactions.

- Multi-Agent Systems—Akira-like orchestrators align identity, basket, and payment.

- Edge-Cloud Continuum—low-latency inference in-store, heavy retraining in cloud.

- Represented by a virtual token Rails—card-on-file, mobile wallet, or palm-vein patterns.

Milestones

| Year | Milestone | Key Figure | Executive Signal |

|---|---|---|---|

| 1974 | First barcode scanned in Ohio | George Laurer | Standardized SKU ID |

| 2016 | Amazon Go beta | Dilip Kumar | Vision leaps from lab to store |

| 2020 | Alibaba Hema hits 200 stores | Hou Yi | Omnichannel becomes baseline |

| 2023 | XenonStack launches Akira | Dr. Jagreet Kaur | Open architecture for mid-market |

| 2025* | EU AI Act enforcement | Margrethe Vestager | Compliance = product feature |

Regulatory Circumstances

The FTC 2023 Privacy Report flags “covert biometric tracking in retail environments” as a priority. Illinois’ BIPA fines run $1,000–$5,000 per violation; only 13 states currently mandate explicit opt-in. Best practice hash events locally, never ship raw video.

Supply-Chain Mechanics

UT Austin’s Supply-Chain Lab notes bill-of-materials costs drop 12 % every additional 100 k sensors ordered, yet shipping volatility adds up to 11 % extra. Dual-source vision modules; prepay PCB fab slots. Chips are tiny, but their logistics write board agendas in capital letters.

Breakthrough Science

Carnegie Mellon’s ShopNet 2.0 achieves 94 % accuracy with only 1 % labeled data via self-supervised transformer trackers. Purdue’s neuromorphic cameras cut power draw 90 %. Yesterday’s CapEx can become tomorrow’s retrofit regret—agility rules.

Three Retailers, Three Lessons

Circle K Oslo—Cold Air, Hot Data

At −10 °C, Circle K’s micro-mart nudged shift workers toward BOGO pastry offers at check-in, lifting revenue 6 %. Energy usage fell 14 % because customers exit faster, doors stay closed, and sensors kill guesswork.

Carrefour Paris—Culture Meets Compliance

Élodie Martel’s 19th-century store drew “surveillance fromage” protests. Privacy glass and edge-only compute quelled objections and pushed net-promoter scores up eight points. Autonomy can charm when transparency accompanies tech.

7-Eleven Tokyo—Tiny Footprints, Giant Footfall

Kenji Watanabe’s smart shelf misread shadows as stockouts until Doppler radar filters arrived. In earthquake-prone Japan, autonomy doubled as toughness shelves stay stocked when humans can’t reach the store.

ROI, Risk, and the Road Map

Financial Model

- CapEx $150 k sensor kit + $50 k edge servers

- Annual savings $120 k labor + $30 k shrinkage

- Upsell lift 4 % on $2 m revenue ≈ $80 k

Breakeven typically arrives in 18–36 months (BCG). Privacy fines or chip shortages distort timelines; situation planning is non-negotiable.

People Strategy

Walmart retrained 10 000 associates as “Autonomy Hosts.” Laughter filled VR classrooms until real layoffs followed. Harvard Business School advocates co-designed career paths and stipend-backed upskilling to blunt backlash.

Cybersecurity Surface

NIST SP 800-218 warns of poisoned labels and sensor spoofing. Target’s CISO Angela Morse merged MLOps and SecOps teams, cutting patch latency by 40 %. Model drift is the new zero day.

Marketing & ESG Alignment

Patagonia-style signage—“We track baskets, not faces”—earns trust. Energy savings and reduced food waste enter ESG scorecards. Autonomous stores convert silence at checkout into shareable delight.

Eight-Step Executive Approach

- Anchor ROI targets labor v. basket lift, 24-month KPIs.

- Conduct a Data-Protection Lasting Results Assessment early.

- Choose modular, open-API stacks to avoid lock-in.

- Model in a dark store before public launch.

- Audit bias and accuracy; include intersectional fairness.

- Upskill staff into experience stewards; fund certifications.

- Roll out in waves best, tier-2, rural micro-pods.

- Iterate monthly on shrinkage, dwell time, NPS, privacy events.

Our Editing Team is Still asking these Questions

1. Does autonomy need facial recognition?

No. Shelf sensors plus anonymous Bluetooth or palm-vein signatures work; biometric ID is optional and opt-in under most laws.

2. How are age-restricted items handled?

Remote or in-store hosts verify ID via video link; compliance remains intact without re-adding checkout lines.

3. Typical installation timeline?

Sensor retrofits take eight weeks for a pilot; full chains scale in 12-18 months pending supply-chain health.

4. Are payment tokens get?

Tokens rely on PCI-DSS vaults plus end-to-end encryption; palm archetypes stay on encoded securely edge nodes.

5. Will all retail jobs vanish?

Brookings finds tasks shift over jobs disappear; customer experience and micro-fulfillment roles expand.

6. KPIs post-deployment?

Shrinkage delta, dwell time, basket size, and privacy incident rate control dashboards.

The Decade Ahead

Expect edge AI to ingest store telemetry and push ultra-fast-local promos within 200 ms, 5G-latency budgets. Neuromorphic cameras will sip milliwatts, turning ceiling grids into neural lace. Ironically, the more invisible the tech, the louder the brand story it enables. In 2030, retail moments may auto-clip to social feeds—shopping as shareable micro-cinema.

Worth Losing Sleep Over

- Edge Model Drift—false positives spike shrinkage overnight.

- Sensor Vandalism—teen pranksters with laser pointers can spoof weight sensors.

- Regulatory Whiplash—patchwork laws create compliance fatigue.

- Public Perception—one viral “creepy store” TikTok can derail rollout.

- Chip Dependencies—geopolitical shocks throttle supply.

Autonomy Options Compared

| Approach | Pros | Cons | Best For |

|---|---|---|---|

| Camera-Only Vision | Low hardware cost | Lighting sensitive | Urban c-stores |

| Camera + Weight Sensors | High accuracy | Higher CapEx | Supermarkets |

| RFID Everything | Simpler compute | Tag cost | Apparel & beauty |

| Vision + LiDAR | Robust in crowds | Complex integration | High-traffic hubs |

Executive Things to Sleep On

- Autonomy converts labor overhead into data capital; disciplined data monetization accelerates breakeven.

- Privacy engineering baked in from day one differentiates brands and cushions regulatory shocks.

- Edge-first, modular platforms buffer chip shortages and guard against vendor lock-in.

- Workforce upskilling turns social risk into community goodwill.

- Merging MLOps with SecOps protects against adversarial shelf attacks—model drift is the new malware.

TL;DR: Autonomy erases checkout lines and writes data lines; profit blooms for leaders who fuse ethics, silicon, and video marketing.

Masterful Resources & To make matters more complex Reading

- NIST SP 1265—Computer Vision Benchmarks for Retail

- Brookings—Automation & the Future of Retail Work

- European Commission—AI Act Overview

- Harvard Business Review—Upskilling Retail Workers for AI

- ShopNet 2.0—Self-Supervised Shelf Tracking

- McKinsey—Future of Checkout

- Google Research—Federated Learning at Scale

By Michael Zeligs, MST of Start Motion Media – hello@startmotionmedia.com