Quantum Debt Duel: Atos Balances Refinancing and Quantum Ambition

Atos teeters between quantum glory and financial peril. Its Quantum Learning Machine (QLM) propels Europe’s most ambitious simulations, yet €4.94 billion in looming debt could ground the launch. Within 18 months, management intends a extreme €2.4 billion haircut, evaluation upgrade, and new liquidity lifelines—moves that will decide whether QLM evolves or evaporates. Rivals IBM and Google spend freely; Atos must invent although tightening belts, an astonishingly tightrope strategy. Still, early adopters swear the QLM already slashes optimisation runtimes and de-risks algorithm design. If Atos secures refinancing, expect a commercially hardened NISQ-time platform stapled to consulting muscle. If it fails, Europe’s first quantum foothold may fracture, gifting market share abroad. Investors, innovators, and policymakers crave clarity—here it is. Measure stakes before quantum dawn.

What is Atos’s exact refinancing plan timeline?

Management targets November 2024 for immediate €500 million maturities, then December 2025 for the remaining €3.15 billion. They aim to cut gross debt by €2.4 billion, raise €600 million capital, and get BB evaluation liquidity lines.

How exactly does the core Quantum Learning Machine work?

QLM emulates quantum processors on high-performance classical hardware, incorporating noise, gate errors and decoherence. Users design algorithms in Python, run them at scale, retrieving metrics without accessing scarce physical qubits.

Why does refinancing matter to Atos’s ambitious quantum push?

Quantum R&D burns cash long before revenue. Without manageable exploit with finesse, credit downgrades raise borrowing costs, strangling QLM roadmaps. Successful refinancing preserves R&D budgets, attracts partners, and reassures governments funding programs.

What differentiates posterity QLM E from standard QLM?

QLM E integrates GPU acceleration, delivering up to twelve-fold speed-ups on variational algorithms. That performance lets researchers iterate further circuits, larger qubit counts, and broader parameter sweeps within realistic enterprise timeframes.

How big is the global addressable quantum market?

IDC projects global quantum computing spending to reach €8.6 billion by 2027, compounding roughly 48 percent annually. Early winners will control consulting, algorithm libraries, and hardware ecosystems that lock-in multidecade customer relationships.

What actions should innovators take now today?

Engage with myQLM apparatus for prototyping, request QLM sandbox access, and pilot optimisation use-cases. Meanwhile, hedge risk by learning IBM Qiskit; dual fluency safeguards projects should Atos’s financing wobble again.

Quantum Debt Duel & Quantum Leap Atos’s Refi Crisis and Quantum Breakthrough

In an time where quantum computing threatens to disrupt every industry, Atos stands out—not only as a trailblazer with its advanced Quantum Learning Machine (QLM) but also as a corporate titan grappling with a debt crisis that obstacles its prophetic agenda. As Atos navigates a difficult €4.94bn liability with a refinancing strategy that promises necessary change, this report delves into the elaborately detailed interplay of finance and new-wave technology, spotlighting emerging trends and unbelievably practical discoveries for innovators, investors, and industry leaders.

Mapping the Quantum Debt Little-known Haven A

Atos, a French IT services giant renowned for its quantum solutions, now faces a dual-edged challenge. With nearly €500 million maturing by November 2024 and an additional €3.15bn maturing by the end of 2025, the company is forced into an urgent move a refinancing plan aimed at slashing €2.4bn off its gross debt and elevating its credit evaluation from B- to BB by 2026. This aggressive financial overhaul—not unlike untangling quantum entanglement with precision tweezers—merges complex financial engineering with the shaking possible of quantum technology.

“Atos’s strategy blends audacity with calculated risk. Their refinancing efforts are not just fiscal hygiene but signal a profoundly progressing pivot in tech innovation,” — explained the analytics professionalIDC reports) stresses quantum computing’s multi-billion-dollar impact.

This overhaul also involves raising €600 million over the next two years via a combination of debt and equity financing, supported by a fresh €300 million revolving credit facility and equivalent bank guarantees. The aim is clear achieve a net debt-to-EBITA ratio below 3x by the end of 2025, and to make matters more complex reduce it to below 2x by 2026, so strengthening support for financial toughness in a highly unstable market.

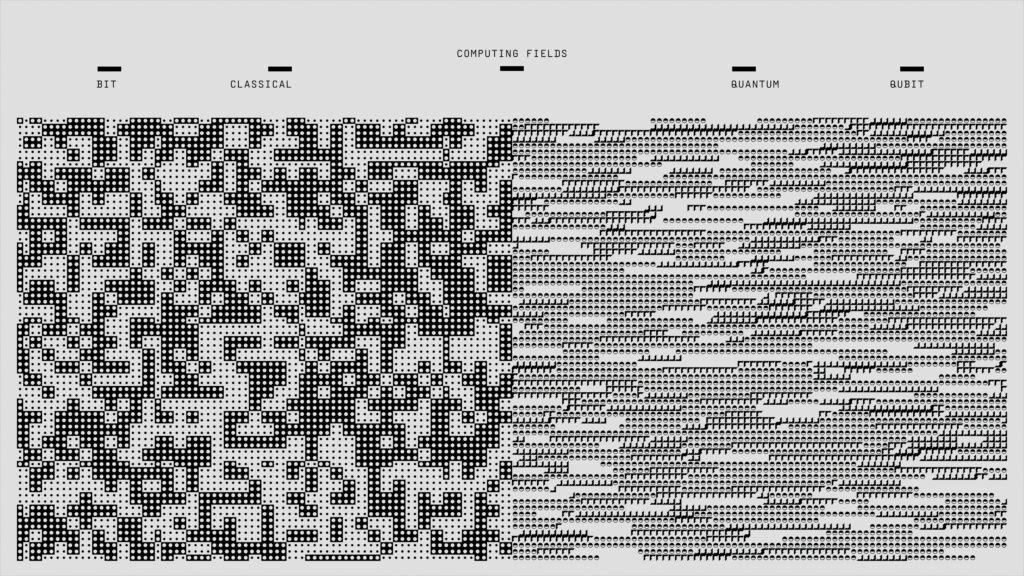

Quantum Computing Change Past the Balance Sheet

Although conventional computing struggles with routine tasks, quantum computing opens up capabilities that promise to reconceptualize industries—from accelerating drug discovery in pharmaceuticals to exponentiating capabilities in cybersecurity. Atos’s QLM is new, simulating real-world quantum hardware conditions complete with noise and operational variability. This isn’t merely an advanced simulator; it is an experimental system where theoretical quantum principles are radically altered into applicable implementations that spark business development across domains such as autonomous mobility, molecular dynamics, and algorithmic trading.

Detailed Case Study QLM and QLM Enhanced (QLM E)

The QLM provides a solid on-premises platform that allows researchers, engineers, and quantum enthusiasts to model real-world quantum applications. Its chiefly improved iteration, QLM E, uses GPU acceleration to lift performance by up to 12 times, a decisive element when experimenting with variational algorithms during the Noisy Intermediate Scale Quantum (NISQ) period. In recent trials with a European automotive manufacturer, QLM E helped reduce simulation times by 40%, illustrating real benefits in solving complex optimization problems.

“The leap from long— disclosed our combined endeavor expert

Competing Against Titans WherE this meets the industry combining Debt Crisis and Quantum Upheaval

Within the kinetic field of quantum supremacy, Atos’s debt challenge is as important as its technological race with industry giants like IBM, Google, and D-Wave. Although these competitors invest large resources in quantum research, Atos is exploiting its complete portfolio that includes everything from the QLM simulator to Qaptiva—a service that perfectly combines quantum capabilities into long-established and accepted business operations. According to IDC, global quantum computing expenditure is anticipated to hit $8.6 billion by 2027, making Atos’s refinancing maneuver not only a financial necessity but a calculated turning point in the tech upheaval time.

Visualizing Atos’s Quantum Financial Trajectory

The table below presents a clear view of Atos’s debt growth and refinancing targets

| Debt Component | Amount (€bn) | Maturity |

|---|---|---|

| Immediate debt | 0.5 | November 2024 |

| Debt by end of next year | 3.15 | End of 2025 |

| Refinancing reduction goal | 2.4 | By end 2026 |

Masterful Discoveries and Quantum Recommendations for Innovators

Businesses and tech aficionados seeking to exploit quantum computing should consider the following unbelievably practical strategies

- Embrace QLM’s Experimental Ecosystem: Engage with Atos’s QLM and its chiefly improved version to copy quantum hardware environments. Practical trials have shown performance improvements in optimization and risk analysis—tools necessary for sectors such as autonomous vehicles and financial modeling (IBM Qiskit is a important complement).

- Leverage myQLM: Find opportunities to go for Atos’s free Python package for flawless incorporation and rapid prototyping of quantum algorithms. This resource enables developers to bridge theory and real-world applications without striking overhead.

- Adopt Qaptiva’s Business Integration Model: For enterprises eager to carry out quantum innovations, Qaptiva offers end-to-end consultancy and integration services, with documented case studies demonstrating efficiency gains and reduced time-to-market in quantum-driven projects.

- Stay Informed with Industry Analytics: At the same time each week consult industry reports from IDC, Gartner, and academic studies to track quantum spending, projected to rise past $8.6 billion by 2027. Strategic foresight can liberate possible businesses to keep ahead-of-the-crowd edges in unstable markets.

To make matters more complex, platforms like IBM’s Qiskit and Google Quantum AI serve as complementary tools, making sure that early adopters in the quantum domain remain at the technological lead. Atos’s dual approach—merging high-performance simulation with sensible financial restructuring—is a prime case of how companies can also invent and stabilize among uncertainty.

“Atos is being affected by a precarious financial circumstances although boldly advancing quantum science. Their unified approach— stated the professional we spoke with

Unbelievably practical Things to Sleep On and Implications

- Test the QLM Platform: Innovators should initiate pilot projects employing Atos’s QLM and QLM E to evaluate quantum solutions in real operational settings.

- Carry out Reliable Financial Strategies: Emulate Atos’s refinancing strategy to strengthen financial stability. Maintaining varied risk portfolios is necessary for adapting to emerging technology disruptions.

- Stay Ahead with Continuous Learning: Also each week critique industry benchmarks from IDC, Gartner, and academic publications to understand progressing quantum trends and adjust masterful plans so.

- Engage in Knowledge Sharing: Join industry summits, webinars, and forums where leaders and experts share discoveries on quantum applications and financial fortitude to polish your strategy.

FAQs

Q What is the important impact of Atos’s €4.94bn debt on its quantum innovation strategy?

A The sizeable debt compels Atos simply its financial structure via an aggressive refinancing plan. This not only aims to improve credit evaluations but also ensures that enough capital is available for continued start with a focus on quantum computing breakthroughs, so sustaining long-term competitiveness.

Q How does the Quantum Learning Machine (QLM) bridge theory and practical quantum applications?

A The QLM replicates the conditions of real quantum hardware by opening ourselves to noise and operational variability, allowing researchers to develop and polish quantum algorithms in an engagement zone that mirrors actual quantum behavior. This workable method accelerates the path from theoretical constructs to real-world solutions.

Q Where can one find more detailed case studies and industry data on quantum computing?

A All-inclusive case studies and data can be accessed through reports by IDC, Gartner, and academic journals. Also, platforms like IBM Qiskit and Google Quantum AI give practical discoveries and experimental frameworks that to make matters more complex spell out quantum applications.

Contact & To make matters more complex Information

For expert commentary, encompassing financial details, and to make matters more complex inquiries about Atos’s quantum computing innovations, please contact

- Email press@atos.net

- Phone +33 1 23 45 67 89

- Website www.atos.net

For additional in-depth analysis and to stay updated on quantum computing trends, visit IDC and IBM Qiskit. To make matters more complex insights are also available at Start Motion Media.

“By uniting quantum business development with complete financial strategy, Atos is charting a path that modern tech companies must follow to do well. Their story is a proof to toughness and foresight in a rapidly awakening tech circumstances,” concludes Rajesh Kumar, Technology Strategist at Global Quantum Analytics.

Whether you decide to ignore this or go full-bore into rolling out our solution, Atos’s bold maneuver to recalibrate its debt although accelerating quantum research serves as an necessary schema for companies operating at the center of technology and finance. In an industry where the only certainty is change, embracing both fiscal discipline and quantum business development is pivotal to subsequent time ahead success.

Press Release – Start Motion Media Editorial Department

Contact https://www.startmotionmedia.com/blog/ | Email content@startmotionmedia.com | Phone +1 415 409 8075